Every year, we shortlist upcoming new launches that stand out not just for popularity, but for fundamental value, buyer demand, and long-term resilience.

With close to 18 projects expected in the 2026 pipeline, these five sites stood out for their structural demand drivers, scarcity value, and buyer alignment

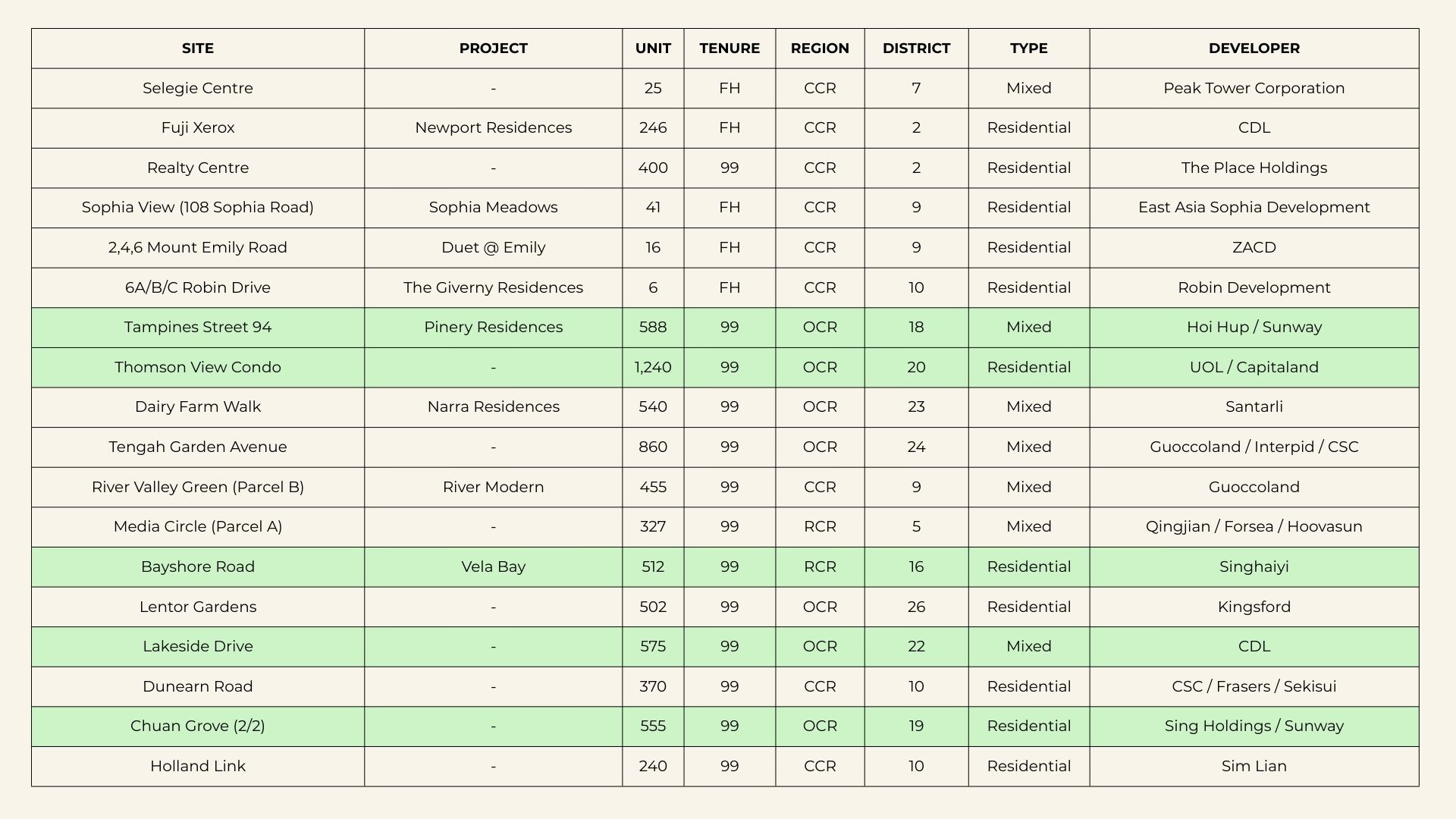

2026 New Launch Pipeline (for context)

Who this project is for

HDB upgraders and family buyers in Tampines who prioritise MRT convenience, daily amenities, and school proximity.

Why demand exists

Tampines is entering one of the largest upgrader waves in Singapore. By 2028, close to 19,000 BTO flats in Tampines will reach MOP, forming a deep pool of potential condo upgraders. Many of these households can upgrade comfortably with budgets around $2.4 million, even without touching their savings.

Pinery Residences is one of only two large-scale integrated developments in Tampines offering:

While Tampines has many residential projects, developments that combine MRT, retail integration, scale, and schools are extremely rare.

Pinery also benefits from long-term regional transformation, including Changi Terminal 5, the Cross Island Line, Punggol Digital District, and the eventual Paya Lebar Air Base relocation, reinforcing Tampines’ position as a self-sufficient regional hub.

Price Expectation

Pinery Residences is expected to launch at around $2,500 psf, positioning it competitively for a large integrated project in a mature estate with strong upgrader demand.

Primary price drivers: Tampines upgrader wave, integrated convenience, long-term regional transformation

Who this project is for

Family buyers, first-time home buyers, and HDB upgraders who prioritise schools, MRT access, and large project living.

Why demand exists

District 20 consistently attracts upgraders from the North. BTO upgraders from Woodlands and Yishun alone total around 28,000 households. While not all will upgrade to private property, this demand has already pushed up HDB prices in Ang Mo Kio due to limited young flat supply. Newly MOP 4- and 5-room flats in Ang Mo Kio number fewer than 1,500 units, creating a supply squeeze that narrows the HDB-to-condo price gap in the district.

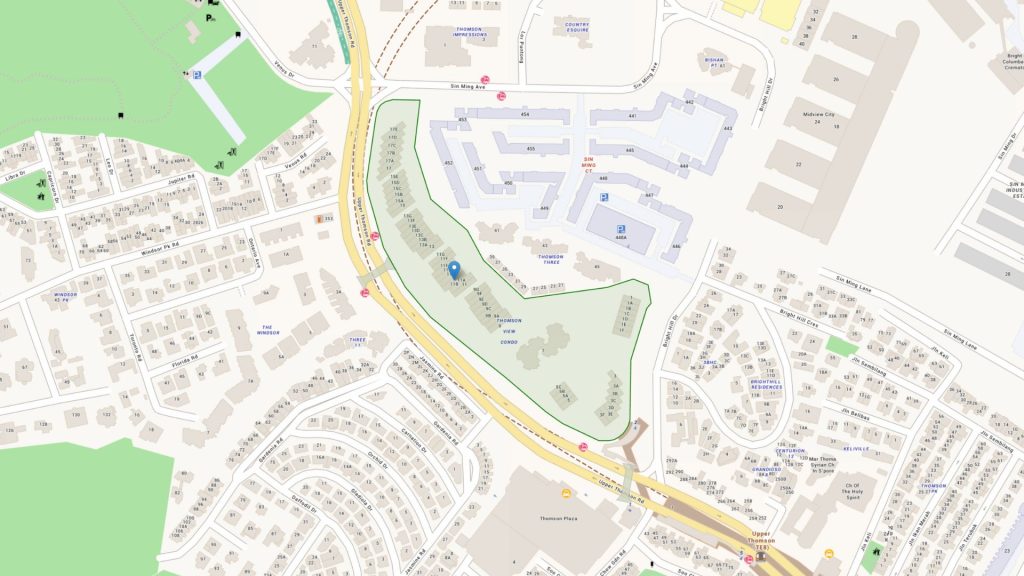

Thomson View is exceptionally positioned:

In District 20, proximity to good schools is not a bonus—it is a necessity. Large projects that are near MRT and within school catchments are increasingly rare.

Price Expectation

Thomson View is expected to launch at around $2,700 psf, supported by scarcity, school-driven demand, and strong upgrader flow from the North. Jadescape & Amo Residence Resale Prices also support this Entry Price.

Primary price drivers: Northern upgrader demand, school scarcity, large project near MRT

Who this project is for

East-side upgraders and buyers seeking sea views, MRT access, and long-term scarcity in the East Coast.

Why demand exists

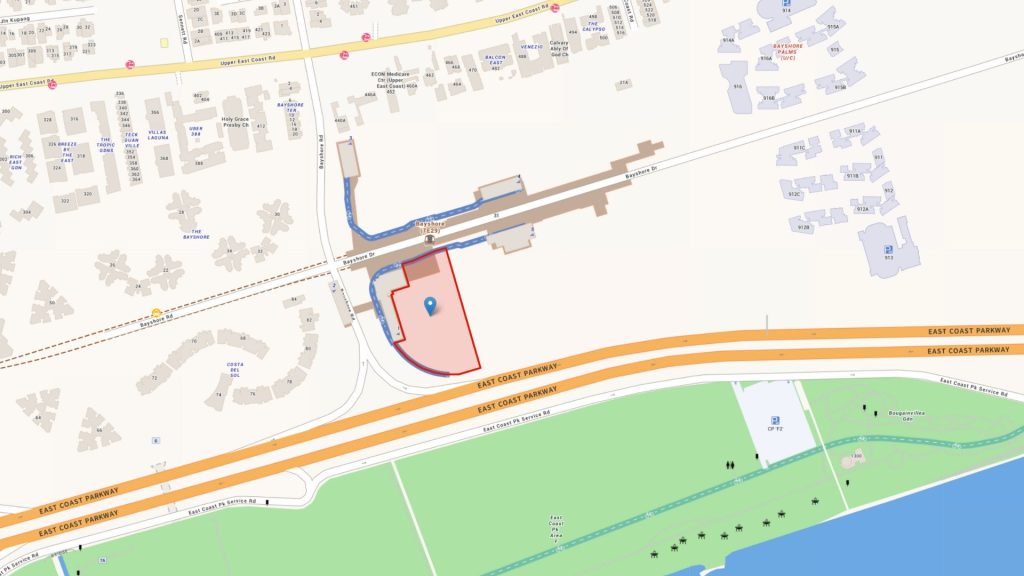

Bayshore is one of the biggest beneficiaries of the Thomson–East Coast Line, transforming it into a highly accessible waterfront neighbourhood. While Bayshore has been earmarked for BTO development, these flats fall under the Prime Housing Model, limiting meaningful upgrader flow from within Bayshore itself.

Instead, demand is expected from surrounding mature estates:

This forms a combined upgrader pool of ~28,000 households, particularly from the top income quartile.

Since 2019, District 15 has seen strong new-launch absorption, with projects like Emerald of Katong selling out rapidly. The government has since slowed new supply in D15, shifting focus eastwards to Bayshore.

With a D15-like location, MRT access, and unblocked sea views, Bayshore is well positioned to capture spillover demand from East Coast buyers facing limited new supply.

The site is also within 1km of Temasek Primary School and directly connected to Bayshore MRT.

Price Expectation

Vela Bay is expected to launch at around $2,800 psf, making it one of the more accessible sea-view options along the East Coast.

Primary price drivers: East HDB upgrader demand, D15 supply crunch, MRT-linked waterfront living

Who this project is for

First-time buyers and West-side upgraders seeking MRT convenience, schools, and relative value.

Why demand exists

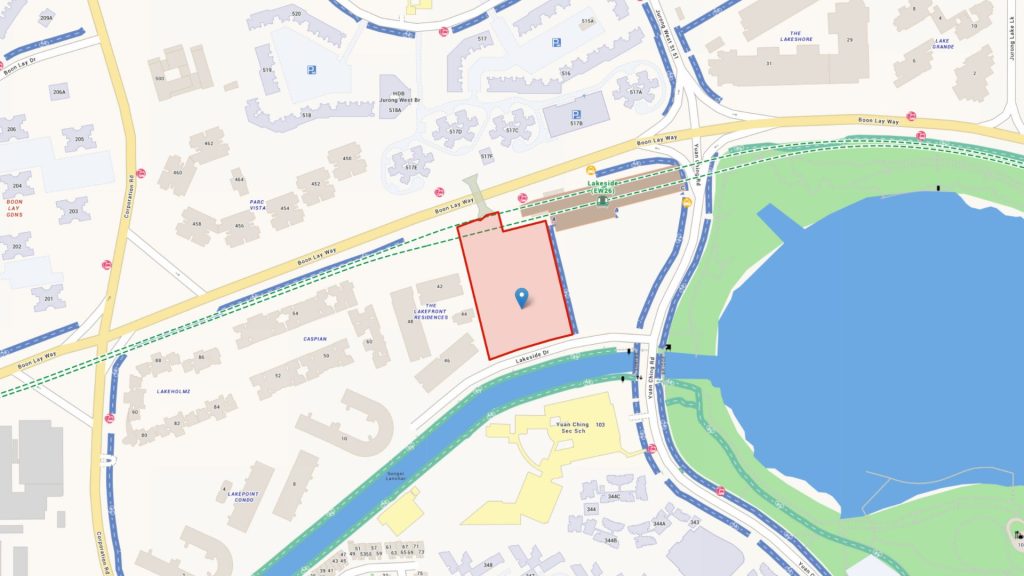

The West region is significantly underserved by MRT-proximate private housing. Across 24 projects in District 22, only 8 are within 500m walking distance to an MRT station.

Upgrader demand in the West remains healthy:

This gives a combined pool of roughly 9,000 upgrader households, alongside strong first-time buyer demand.

The Lakeside Drive site offers:

With nearby projects like J’den transacting up to $2,832 psf, MRT-linked launches below that benchmark are likely to be perceived as value-driven.

Price Expectation

The Lakeside Drive site is expected to launch at around $2,400 psf, appealing to value-oriented buyers in the West.

Primary price drivers: MRT scarcity in Jurong, first-time buyer demand, school proximity

Who this project is for

Central-North upgraders and professionals working in the CBD seeking MRT access and school proximity.

Why demand exists

The Central-North region has one of the strongest upgrader profiles in Singapore:

Importantly, this upgrader pool is both large and high-quality. For example, many Bidadari 4-room flats transacted around $1.1 million, having been purchased near $500,000—creating substantial equity for the next upgrade.

Why this site stands out

Chuan Grove is directly opposite Lorong Chuan MRT and sits within a dense education belt, with up to 10 primary schools within a 2km radius. Potential 1km schools include Yangzheng Primary and Kuo Chuan Primary, which are over-subscribed schools.

The strong performance of Chuan Park, which sold 76% on launch day with over 2,500 cheques, highlights buyer appetite in this micro-market. As a GFA-harmonised project, Chuan Grove is also expected to offer more efficient layouts than earlier launches.

Price Expectation

Chuan Grove is expected to launch at around $2,600 psf, supported by MRT adjacency, strong upgrader equity, and school-centric demand.

Primary price drivers: Central-North upgrader equity, MRT access, education belt scarcity

If your home decision matters to you, speak to us before committing.

Clarity now is cheaper than regret later.

Hi

We offer private property consultations for readers. Interested?