When buyers compare a 99-year leasehold condo vs a freehold condo in Singapore, the decision often feels straightforward. Freehold is widely seen as superior, more permanent, more prestigious, and better for long-term wealth preservation.

But when we examine actual price performance, transaction volume, and buyer behaviour, the data tells a more nuanced story.

In Singapore’s private property market, tenure alone does not determine returns. What matters more is who can buy the property, how often it trades, and whether demand remains deep over time.

To truly understand whether a freehold condo or a 99-year leasehold condo makes sense, we need to look beyond labels — and into structure.

Many buyers believe that a freehold condo protects value indefinitely and can be passed down across generations without the risk of lease decay.

This belief explains why buyers are often willing to pay a freehold condo price premium, even if it means:

However, a longer tenure only answers one question: How long can value exist?

It does not answer the more important one: Will demand exist when you need to exit?

To understand performance properly, we first need to look at how projects are structured across the market.

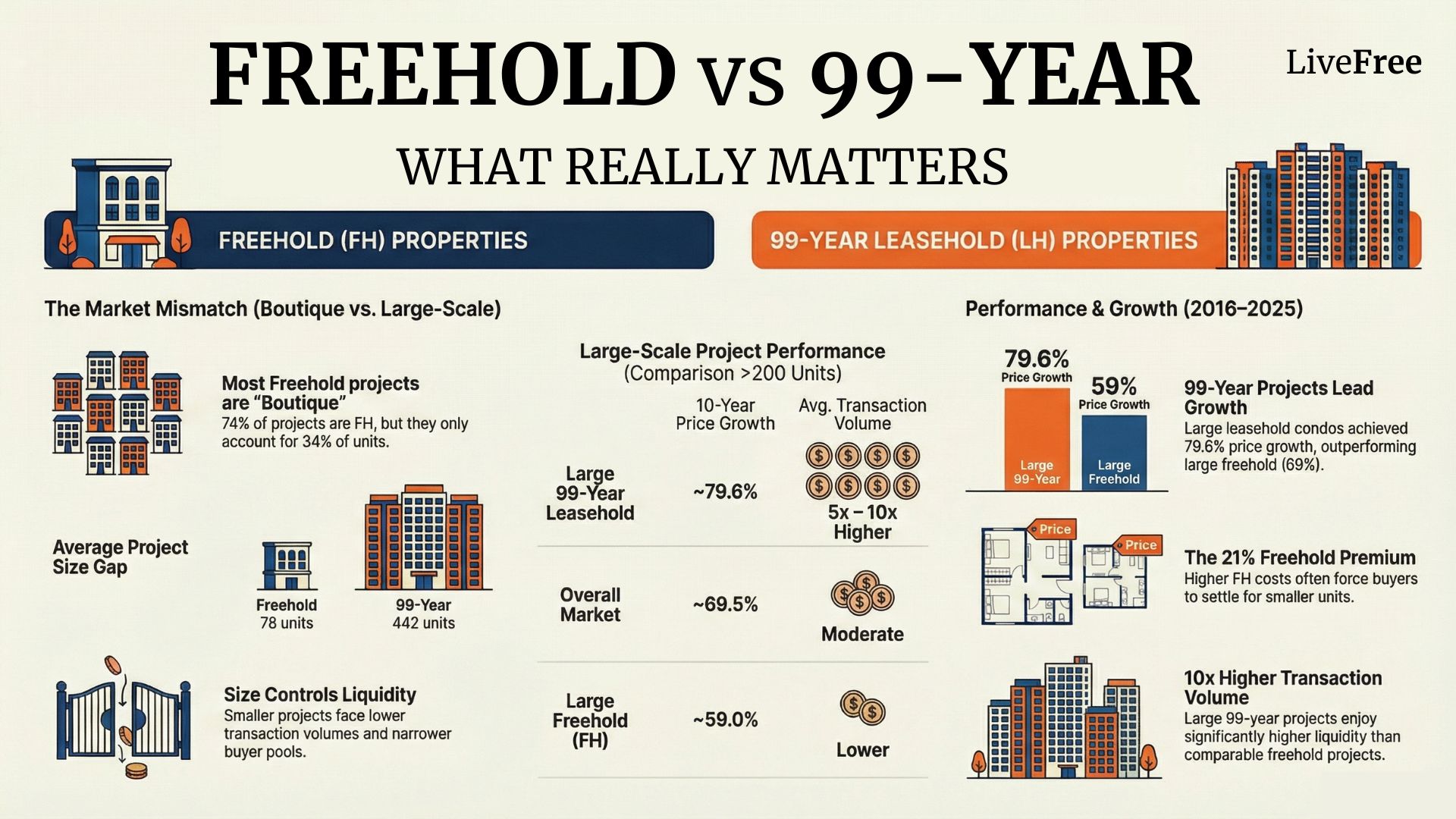

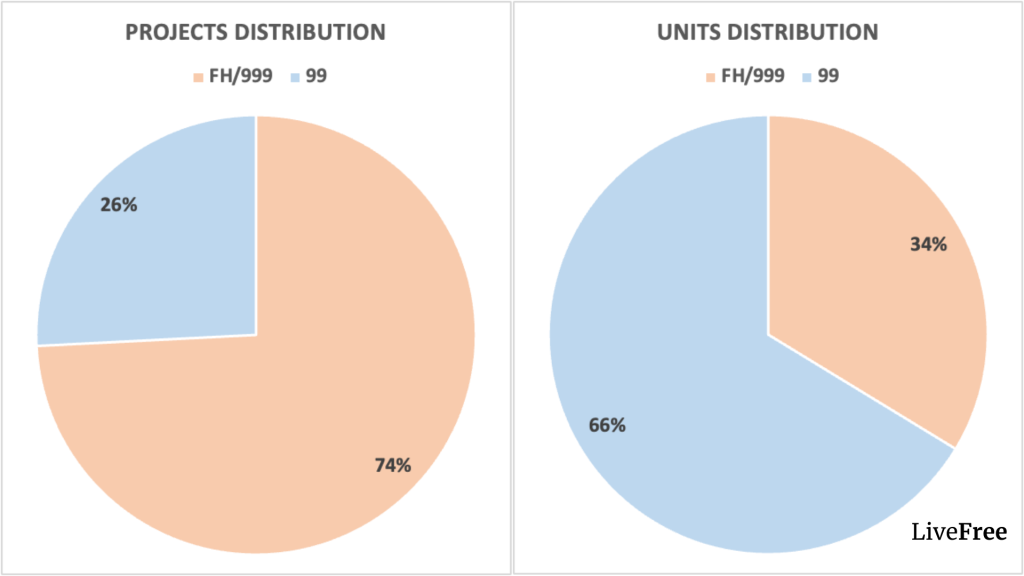

Across Singapore’s private residential landscape:

This imbalance reveals a critical structural reality.

Most freehold condos in Singapore are small, boutique developments, while the majority of large-scale projects are 99-year leasehold. As shared in our previous investor insights [here], project size directly affects liquidity, buyer pool depth, and resale behaviour — factors far more influential than tenure alone.

Why “Average” Freehold Performance Can Be Misleading

More than 90% of freehold and 999-year condos have fewer than 200 units. In other words, the “average” freehold condo in Singapore is actually a boutique project.

Historically, boutique developments tend to face:

This has led many to conclude that boutique condos underperform.

But when we isolate the data properly, a more precise conclusion emerges.

To fairly compare freehold vs 99-year leasehold condo performance, we must control for project size

With a better understanding of how projects and units are being distributed among the private condo market, we can now research price trends.

First, we’re going to separate the “Boutique” out from the average FH/999 prices so that we can have a fair assessment.

Second, we’ll compare both data against 2 control groups. All FH/999 Project price trends, as well as the overall market.

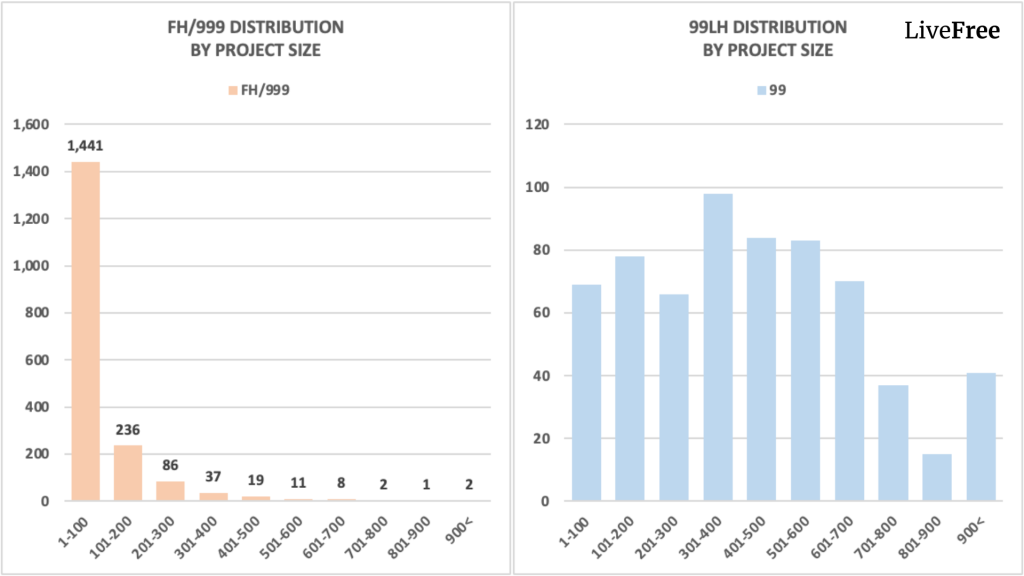

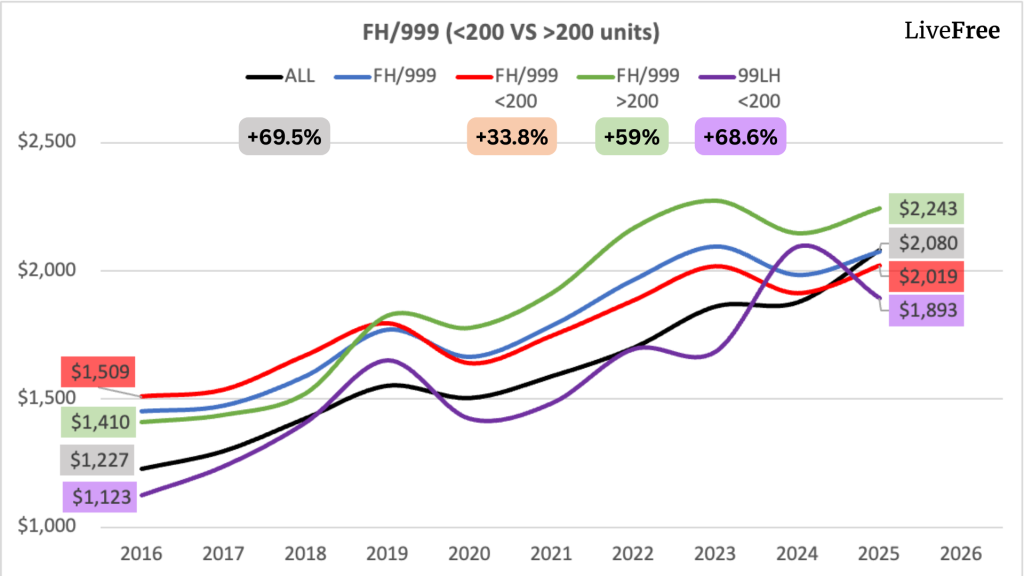

Trend 1: Small Freehold Condos Performed the Worst (RED)

Freehold condos with fewer than 200 units:

This confirms that liquidity constraints, not just market cycles, suppress performance in this segment.

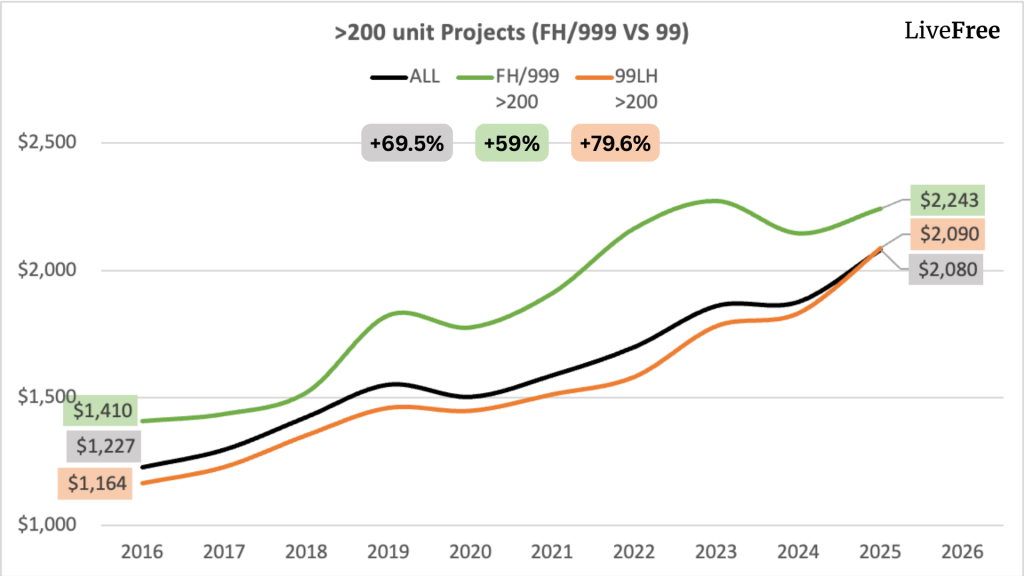

Trend 2: Large Freehold Condos Perform Better — But Still Lag (GREEN)

Freehold condos with more than 200 units perform way better than small freehold projects.

Over a 10-year period:

Even when size is no longer a disadvantage, freehold condos still failed to outperform the broader market.

This leads to an important comparison.

Trend 3: Small 99yrs Condos Performed In Line With the Market (PURPLE)

Here is where the narrative shifts. 99-year leasehold condos with fewer than 200 units did not underperform.

In fact, they:

This breaks the assumption that “boutique” is the real problem.

The data shows clearly that Small Freehold Condos are the isolated anomaly. Not Boutique Projects as a whole.

Trend 4: Large 99-Year Leasehold Condos Outperform all categories (ORANGE)

When we compare large projects on an equal footing, the result is unambiguous.

Large 99-year leasehold condos achieved approximately:

Once project size is equalised, 99-year leasehold condos delivered the strongest performance across all segments.

Historically, 99-year leasehold condos are priced at a meaningful discount.

In 2016:

This ~21% freehold premium has real consequences. With a $1.5 million budget in 2016, buyers can often afford either:

In a market dominated by families and HDB upgraders, size and liveability frequently outweigh tenure.

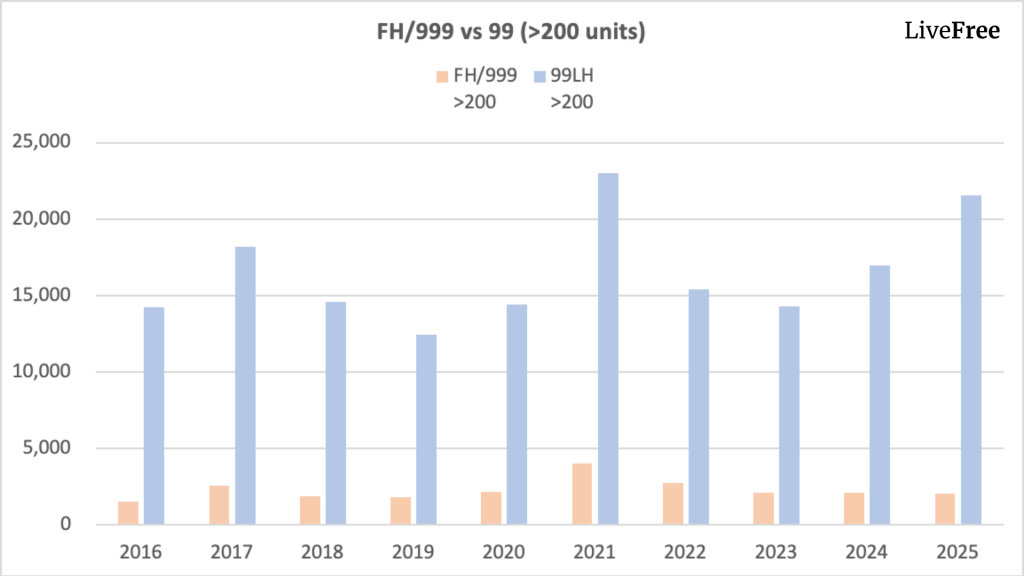

Liquidity and Transaction Volume

Large 99-year leasehold condos easily record 5 to 10 times more transactions than comparable freehold condos.

Higher liquidity leads to:

Freehold condos rarely crash — but many stagnate quietly due to limited turnover.

Buyer Pool Depth

99-year leasehold condos attract: HDB Upgraders, Family Homebuyers, Mass-market demand

Freehold condos rely on: Private homeowners, Legacy-driven buyers, A narrower affordability band

A smaller buyer pool limits upside, regardless of tenure.

Tenure affects how long value can last. Demand determines whether value exists at all.

Banks do not treat freehold condos more favourably in financing, and buyer affordability continues to cap resale prices. Freehold condos rarely crash — but many stagnate quietly when liquidity is weak.

The wrong question is:

The right questions are:

Because in Singapore’s property market, the best condo investment is not defined by tenure — but by demand, affordability, and exitability.

Live Freely & Find the Right Home with us today.

Hi

We offer private property consultations for readers. Interested?