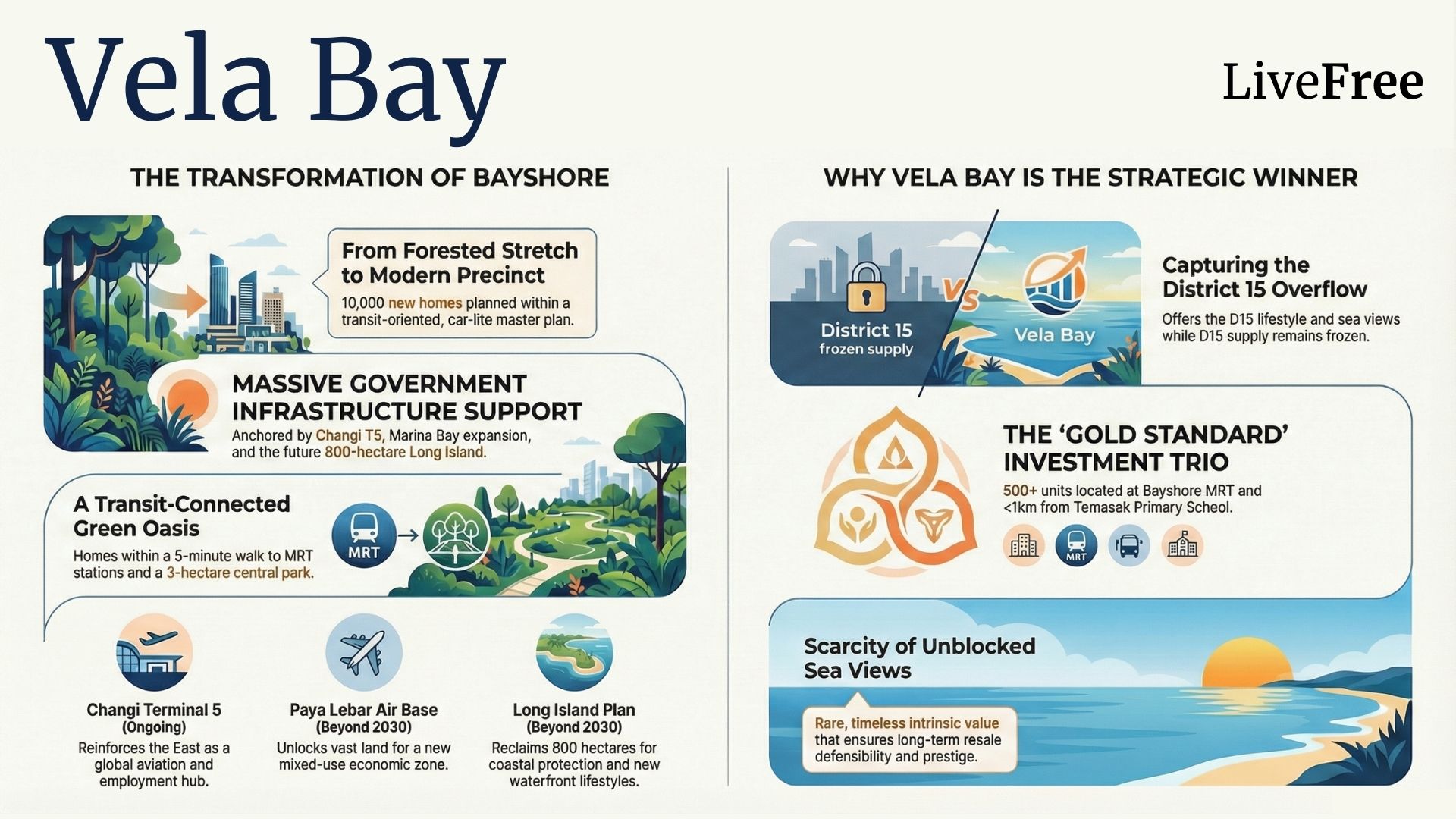

Vela Bay is one of Livefree’s Top Five New Launch Projects in the 2026 pipeline. While unblocked sea views are the most obvious draw, what truly differentiates Bayshore in today’s Singapore property market is timing.

Vela Bay is the first private residential launch within a brand-new Bayshore estate, entering the market just as East Coast supply tightens and long-term government investment accelerates.

What is Bayshore?

Bayshore was previously a forested stretch at the eastern end of East Coast Park, earmarked for residential use as early as the URA Master Plan 1998. On 16 October 2023, the Minister for National Development unveiled the detailed master plan for the new Bayshore housing estate.

When fully developed, Bayshore will comprise approximately 10,000 new homes, of which about 70% (around 7,000 units) will be public housing. The first two BTO projects have already launched and were both oversubscribed, reflecting strong demand for the area. Vela Bay will be the first private condominium launch within this new estate. The precinct is planned around a car-lite, transit-oriented concept.

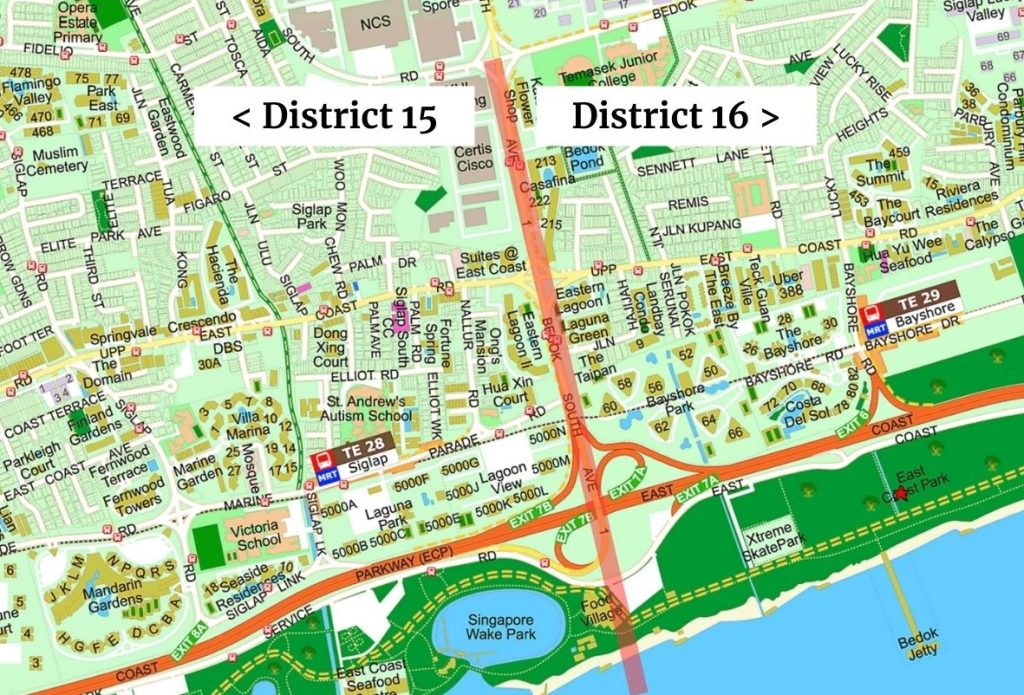

District 16 on Paper, District 15 in Lifestyle

The boundary between Districts 15 and 16 runs along Bedok South Avenue 1 (near ECP Exit 7). Lagoon View sits at the edge of District 15, while Bayshore Park lies on the fringe of District 16. Bayshore is technically located in District 16, but in reality, it offers many of the lifestyle characteristics traditionally associated with District 15.

For buyers who value the East Coast lifestyle but find homes in District 15 increasingly out of reach, Bayshore presents a compelling and more accessible alternative.

Rarity in Projects with Unblocked Sea Views

Along the East Coast Parkway, there are only around 20 +/- residential projects with unblocked sea views — and even among these, not all units enjoy direct views.

In Singapore’s property market, unblocked sea views have strong emotional appeal across buyer profiles, and signifies lifestyle prestige, rarity, and permanence.

More importantly, sea views represent a form of intrinsic value. Unlike design trends or interior finishes, a sea view is timeless and universally understood. This makes the premium highly transferable, contributing to long-term price resilience and resale defensibility.

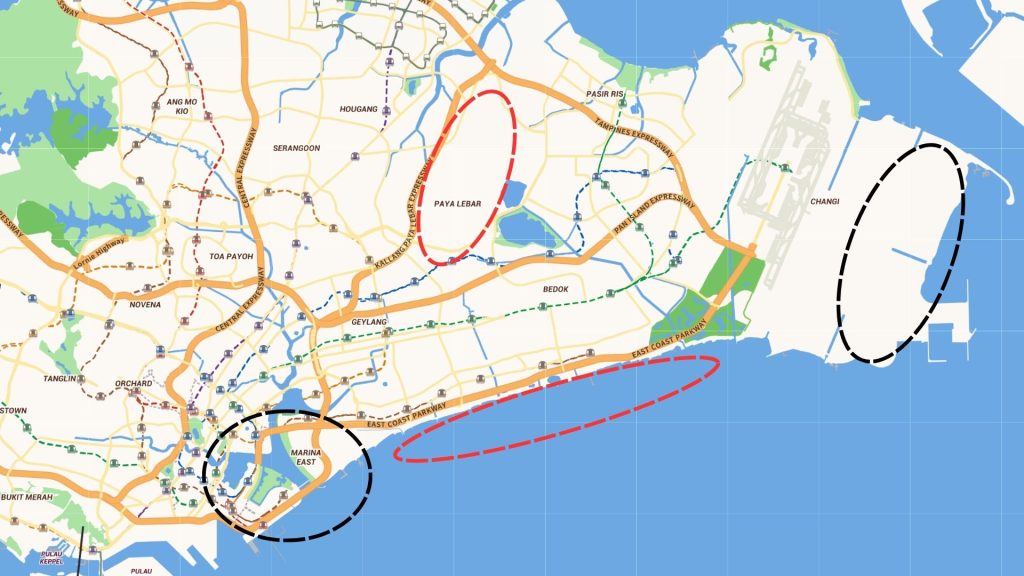

Bayshore sits at the centre of several long-term government initiatives that are reshaping Singapore’s eastern region, not just physically, but economically.

Changi Terminal 5 (Now)

To the east, Changi Terminal 5 represents one of Singapore’s most significant infrastructure investments. When completed, T5 will reinforce Changi’s position as a global aviation hub, supporting not just tourism, but also aviation-linked industries, logistics, and high-skilled employment. This strengthens the eastern region as a major employment node, reducing reliance on the traditional city centre and increasing the appeal of homes located closer to Changi.

Marina Bay Downtown Core (Now)

Towards the city, the continued expansion of Marina Bay has transformed Singapore’s Downtown Core into a globally recognised financial and business address. As the CBD continues to extend eastwards, the East Coast increasingly sits between two powerful economic anchors — Marina Bay on one end and Changi on the other. This creates a natural demand corridor for residential locations that offer accessibility to both.

Paya Lebar Air Base Relocation (Beyond 2030)

Looking further ahead, the Paya Lebar Air Base relocation, expected in the 2030s and beyond, will unlock a vast tract of land for future redevelopment. This area is widely anticipated to evolve into a new mixed-use economic zone, supporting a combination of commercial, lifestyle, and residential uses. Over time, this adds another layer of employment and activity closer to the East Coast.

Long Island Plan (Beyond 2030)

Finally, the Long Island Plan is a large-scale coastal protection and land reclamation initiative, reclaiming approximately 800 hectares of land — about twice the size of Marina Bay. Beyond safeguarding Singapore against rising sea levels, the project is expected to introduce higher-elevation land, new waterfront spaces, and a freshwater reservoir, while significantly expanding recreational and lifestyle areas along the coast.

A Never-Ending Growth Story

Collectively, these initiatives position the East Coast in a uniquely advantageous location — in the short term, between Singapore’s primary financial hub and its aviation gateway, and in the long term, supported by emerging economic zones in Paya Lebar and Long Island. For developments like Vela Bay, this translates into structural demand driven by long-term planning, rather than a single catalyst.

Lifestyle Choice

Even before the Thomson–East Coast Line, the East Coast was already a lifestyle destination. With full MRT connectivity today, it has evolved into both a weekend family hub and a corridor many East-side residents pass through daily, reinforcing its visibility and relevance.

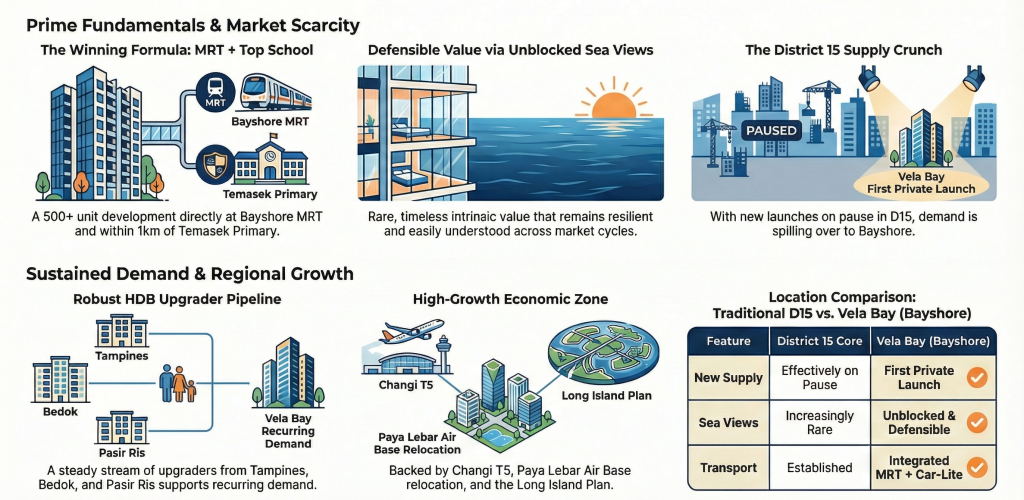

HDB Upgraders from the East

From the eastern heartlands alone, Tampines, Bedok, and Pasir Ris collectively contribute around 30,000 HDB households reaching MOP from 2020 onwards. This forms a sizable and recurring pool of potential HDB upgraders entering the private market.

Island-wide Buyer Pull

However, unlike heartland regions where buyers tend to stay close to familiar neighbourhoods, the East Coast has historically attracted demand from across Singapore. This is largely due to its proximity to multiple employment nodes and its long-established lifestyle appeal.

Tenant-Converts

In addition, many long-term tenants who have lived in the East Coast and later convert to Singapore Citizens or PRs consistently rank the East Coast among their top two residential choices, alongside River Valley.

District 15 Buyer Mix

As a result, buyer profiles in the East Coast typically comprise ~80% private homeowners and ~20% HDB upgraders. This reflects the East Coast’s long-standing appeal to private buyers and tenant-converts, alongside a growing upgrader base.

Crucially, District 15 is entering a period of extremely limited new supply.

Over the next two years, there are no confirmed Government Land Sales (GLS) sites scheduled for District 15. At the same time, while en-bloc discussions continue to surface from time to time, none have translated into successful collective sales.

This is significant because District 15 consistently ranks the highest-transaction district in Singapore, driven by its lifestyle appeal, school networks, and proximity to the city. Demand has remained resilient, yet the new launch pipeline has effectively stalled.

When demand persists but fresh supply pauses, buyers who are committed to the East Coast lifestyle are left with limited choices. As a result, attention naturally shifts to nearby alternatives that offer similar attributes — proximity to the coast, MRT connectivity, and lifestyle appeal — without the scarcity premium that fully built-out districts tend to command.

In this context, Bayshore becomes a natural beneficiary. While it sits just outside District 15 administratively, it functions as an extension of the East Coast residential belt, offering what many buyers are seeking but can no longer find within District 15 itself: a sizeable new launch, modern planning, MRT access, and true waterfront living.

This supply dynamic reinforces why Bayshore’s first private launch matters. It is not competing in an oversupplied market — it is arriving precisely when new supply in the East Coast core is constrained, creating a favourable backdrop for buyer interest and long-term price support.

Vela Bay brings together a set of fundamentals that are rarely found in a single new launch condo in Singapore, especially within the East Coast.

Asset Class with Proven Track Record

Large-scale developments that sit next to an MRT station and within 1km of a popular primary school have consistently proven to be among the strongest-performing residential projects over time. Vela Bay fits squarely within this category — a 515 unit development, located directly at Bayshore MRT, and within 1km of Temasek Primary School, an oversubscribed school where proximity is often a necessity rather than a bonus.

Intrinsic Value with Unblocked Sea Views

Beyond schools and transport, Vela Bay also offers rare unblocked sea views, a scarce and defensible attribute along the East Coast. Unlike design features that change with trends, sea views represent intrinsic value that is easily understood and typically retained through market cycles.

HDB Upgrader demand from the East

Demand is further supported by a steady pipeline of HDB upgraders from the eastern heartlands, including Tampines, Bedok, and Pasir Ris, providing recurring owner-occupier demand for well-located family homes.

Supply Crunch in District 15

At the same time, new supply in District 15 is effectively on pause, despite being one of Singapore’s most actively transacted districts. This creates a natural spillover effect, positioning Bayshore — and Vela Bay in particular — as the next logical option for buyers seeking East Coast living but unable to find suitable new launches within District 15 itself.

High-Growth Zone

Finally, sustained government investment across the eastern region, from Changi Terminal 5 to the Paya Lebar Air Base relocation and the Long Island Plan, continues to reinforce the East Coast’s long-term economic and lifestyle relevance.

Taken together, these factors align timing, demand, and scarcity, explaining why Vela Bay stands out within the 2026 new launch landscape.

If your home decision matters to you, speak to us before committing. Clarity now is cheaper than regret later.

LiveFree

Hi

We offer private property consultations for readers. Interested?