How to Read This Market Insights Article

This Market Insights piece is structured as a data-led overview of Singapore’s residential property market. The first 4 sections focus strictly on factual statistics and publicly available data, covering price movements, transaction volumes, and supply conditions across the private and public housing markets.

Interpretation and forward-looking views are intentionally reserved for the final section, where we share what these numbers may imply for the 2026 property landscape.

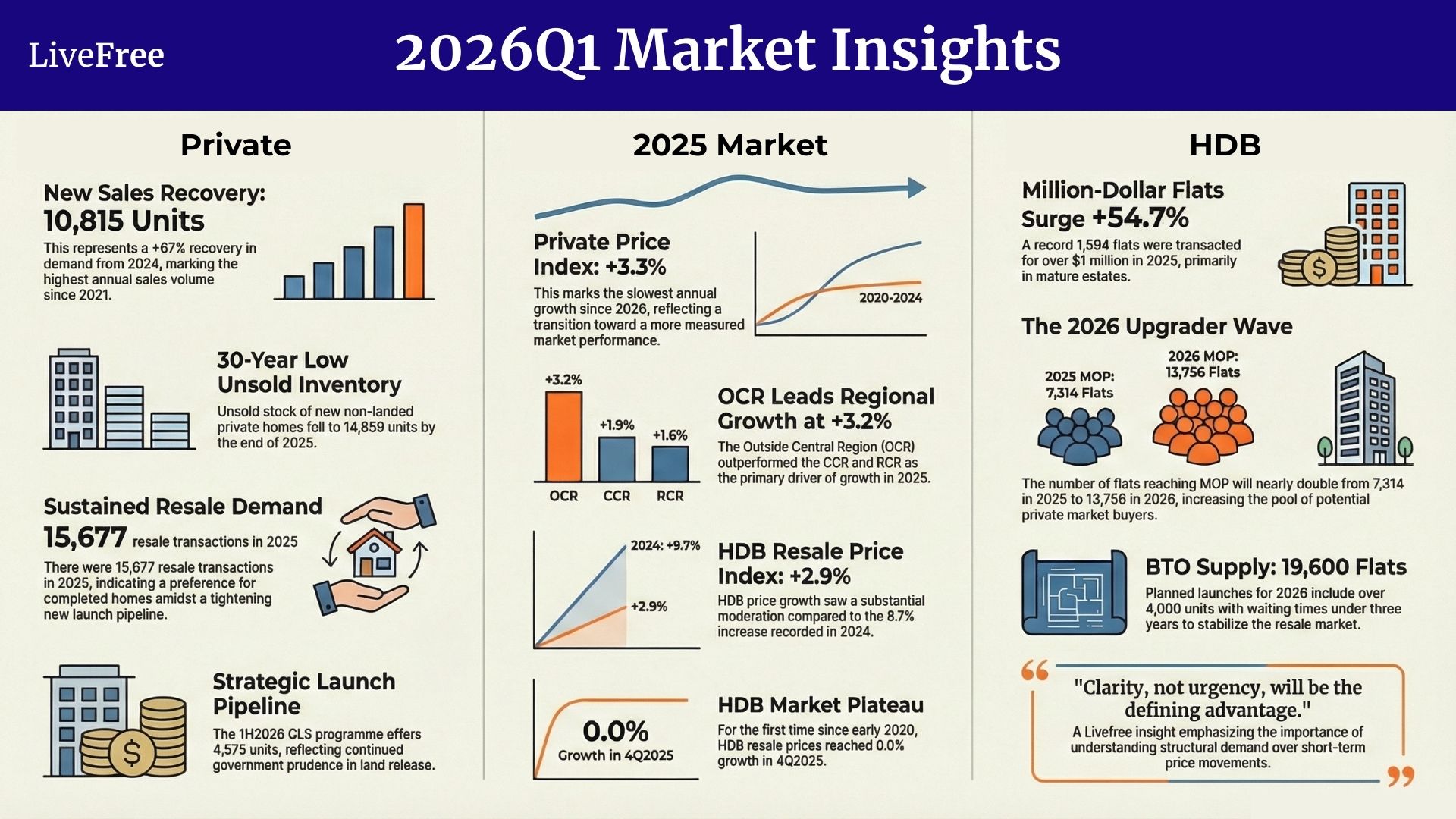

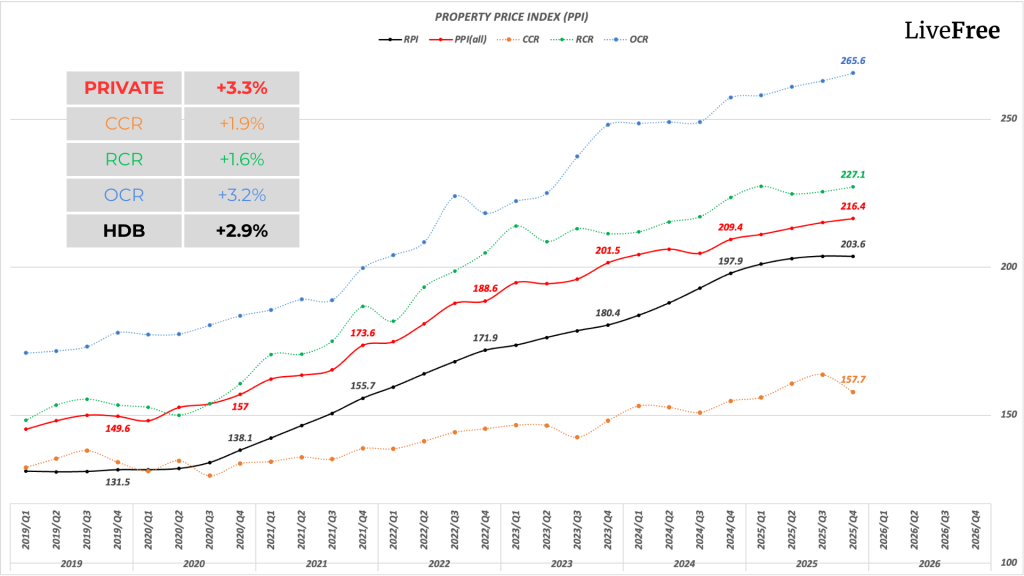

Singapore’s private residential property price index rose by 3.3%, marking the slowest annual growth since 2020 and a step down from the 3.9% increase in 2024.

This moderation reflects a market transitioning away from broad-based acceleration towards a more measured and segmented performance, shaped by disciplined developer pricing and structural supply measures under the Government Land Sales (GLS) programme.

Segment Performance

New Private Home Sales

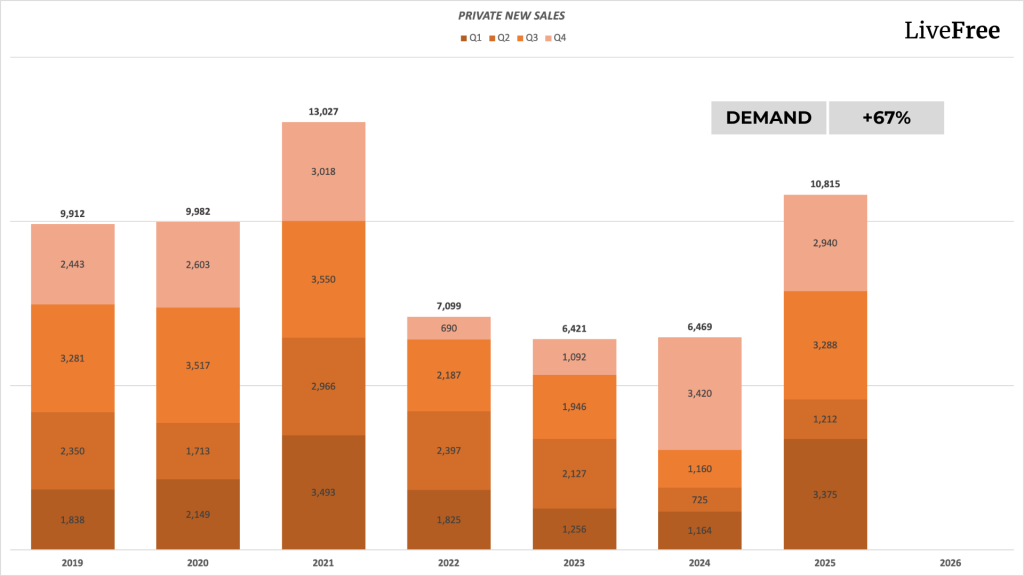

The primary market experienced a significant recovery in 2025, with developers selling 10,815 new private residential units (excluding ECs). This marked a sharp increase from 6,469 units in 2024 and represented the highest annual sales volume since 2021.

The rebound was supported by:

Private Resale Market

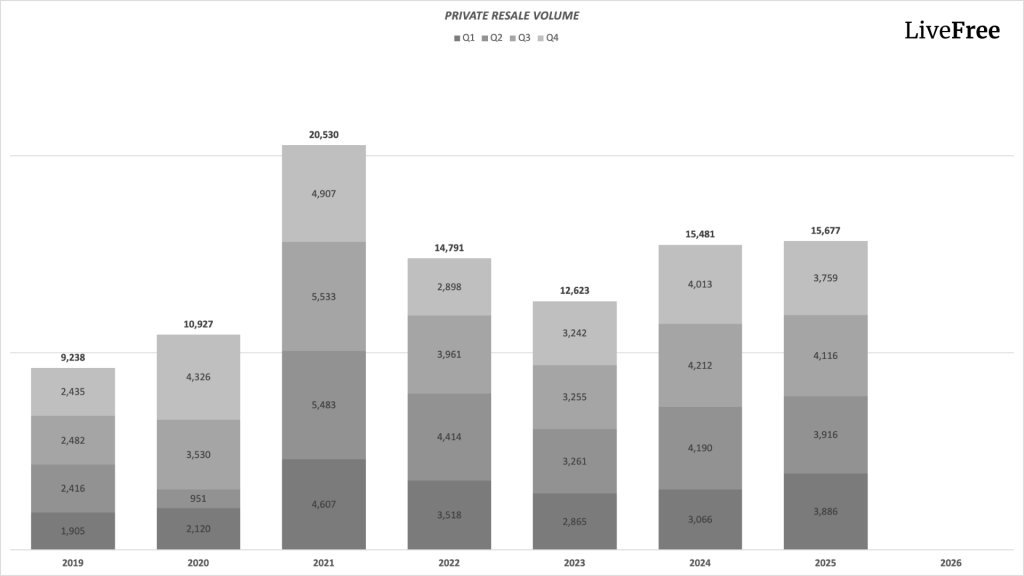

The private resale segment also saw a modest increase in activity, with 15,677 resale transactions in 2025, slightly higher than 15,481 units in 2024. This indicates sustained demand for completed homes alongside the recovery in the primary market.

Unsold Stock and GLS Supply

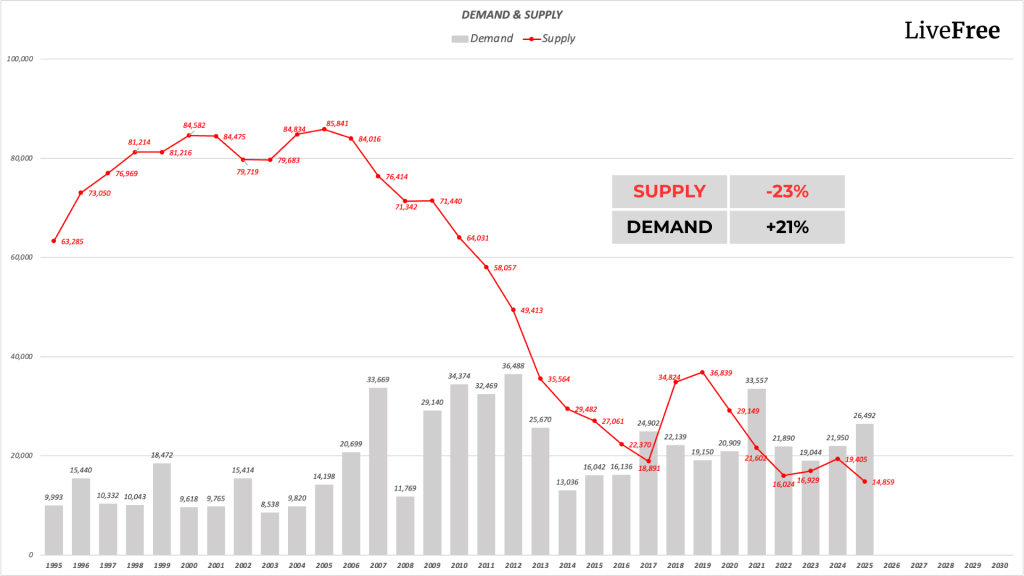

As of end-2025, the unsold inventory of new non-landed private homes stood at 14,859 units, one of the lowest levels in over 30 years.

The GLS Programme for 1H2026 offers 4,575 units, including EC supply, slightly lower than the 2H2025 pipeline. This reflects continued prudence in land release amid existing supply constraints.

HDB Resale Prices and Volumes

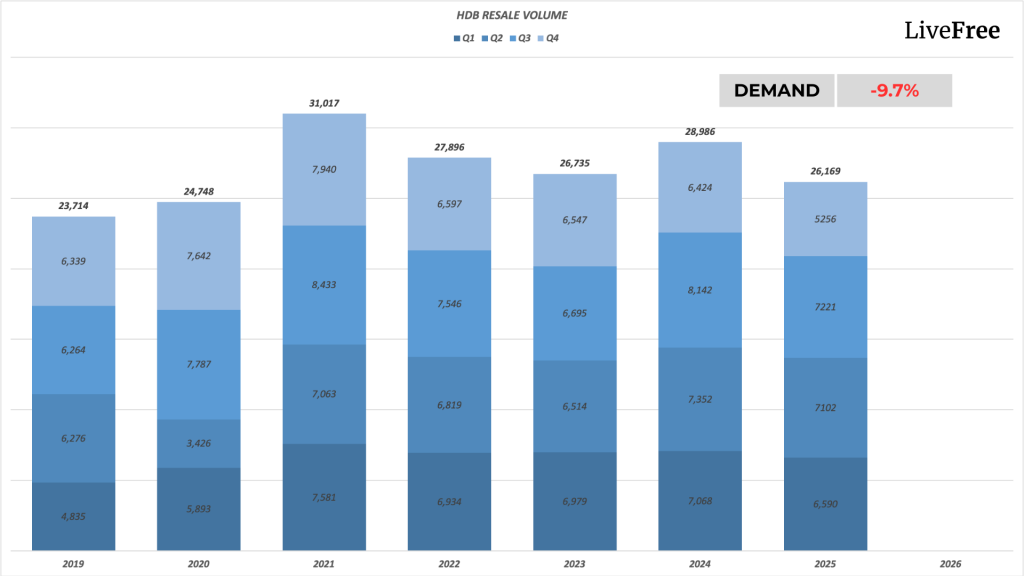

The HDB resale market reached a notable inflection point in 4Q2025, with prices plateauing at 0.0% growth for the first time since early 2020. For the full year, resale prices rose 2.9%, a substantial moderation from the 9.7% increase recorded in 2024.

Resale volumes declined from 28,986 transactions in 2024 to 26,169 in 2025, a 9.7% decrease year-on-year.

This was largely attributed to:

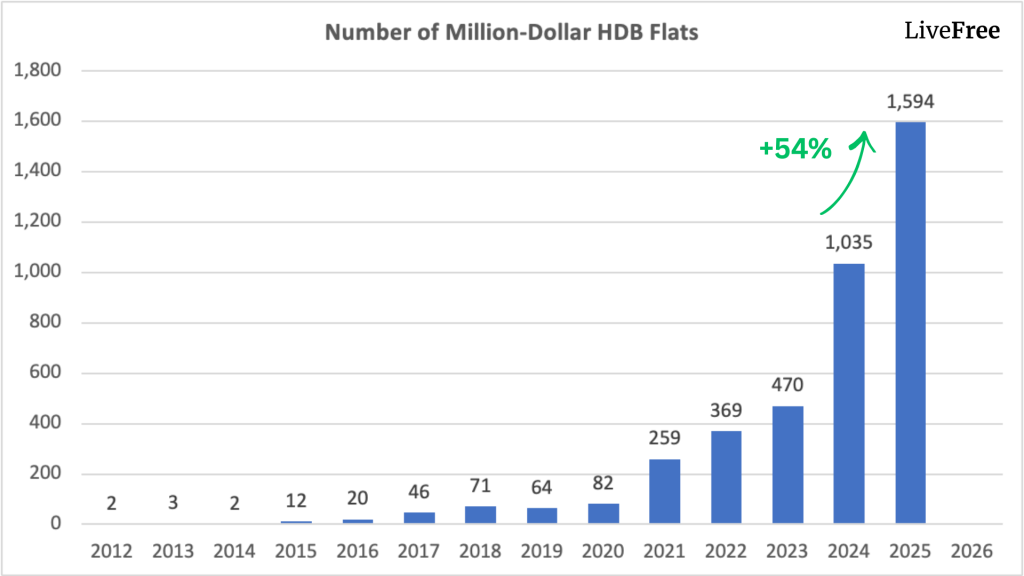

Million Dollar Flats

Despite broader moderation, the high-end HDB segment continued to set new benchmarks. A record 1,594 million-dollar flats were transacted in 2025, representing a 54.7% increase from the previous peak of 1,035 units in 2024.

Over half of these transactions involved flats aged 15 years or below, predominantly located in mature estates with strong connectivity and amenities.

BTO Supply and MOP Outlook

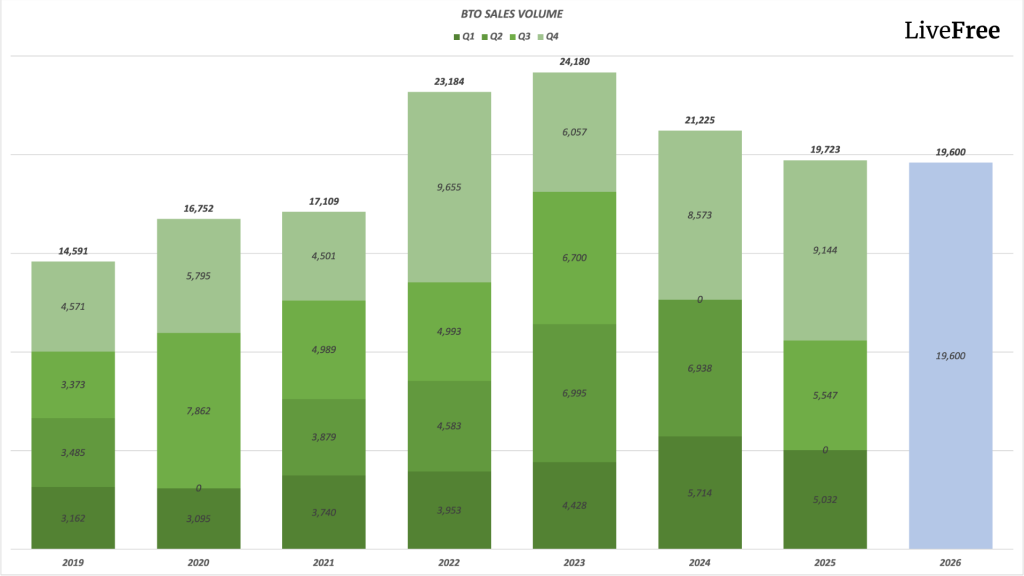

Looking ahead, the government plans to launch approximately 19,600 BTO flats in 2026, spread across three sales exercises. More than 4,000 units are expected to have waiting times of under three years, continuing efforts to stabilise the resale market.

At the same time, the number of flats reaching MOP is projected to almost double, rising from 7,314 units in 2025 to 13,756 units in 2026, increasing the pool of potential upgraders.

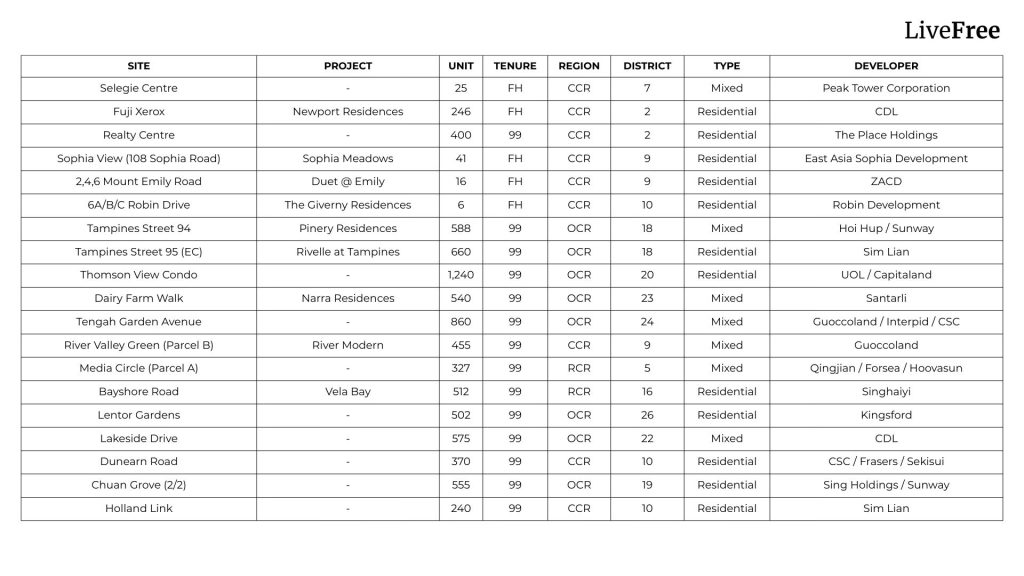

The new launch pipeline for 2026 is characterised by a more balanced but narrower choice set, with a greater proportion of larger developments and fewer popular options compared to 2025.

This shift reflects the cumulative effects of controlled land release, project absorption in 2024–2025, and the current unsold inventory levels.

While the data above is descriptive, several structural patterns emerge when viewed collectively.

Price growth has moderated, but demand has not disappeared — it has become more selective and more segmented. OCR continues to demonstrate resilience, supported by affordability considerations and upgrader demand, while CCR performance reflects higher sensitivity to pricing expectations.

The recovery in new home sales in 2025 has reduced available inventory, and with fewer launch options in 2026, resale homes may play a more prominent role in meeting buyer demand.

On the public housing front, a stabilising resale market, rising million-dollar transactions, and a sharp increase in flats reaching MOP suggest a renewed wave of HDB upgraders entering the private market — particularly into OCR and RCR segments.

If current supply conditions persist, 2026 may be less about broad-based price acceleration and more about where demand concentrates, which segments benefit, and how limited choice reshapes buyer behaviour.

In a market where headlines often focus on short-term price movements, understanding structural demand, supply depth, and buyer flow matters far more than chasing momentum.

For buyers and homeowners planning their next move in 2026, clarity — not urgency — will be the defining advantage.

If your home decision matters to you, speak to us today.

LiveFree

Hi

We offer private property consultations for readers. Interested?