Regardless of whether buyers were considering a 2 bedroom or a 4 bedroom unit, the underlying fear was often the same — what if I buy the wrong unit type and can’t sell it later?

This raised an important question. Are buyers across different unit types reacting to different market realities, or are they all responding to the same uncertainty — simply without clear, comparable information?

To find clarity, we analysed 10 years of condo transaction data across different unit types, examining how buyer demand, supply, and price performance have actually evolved over time.

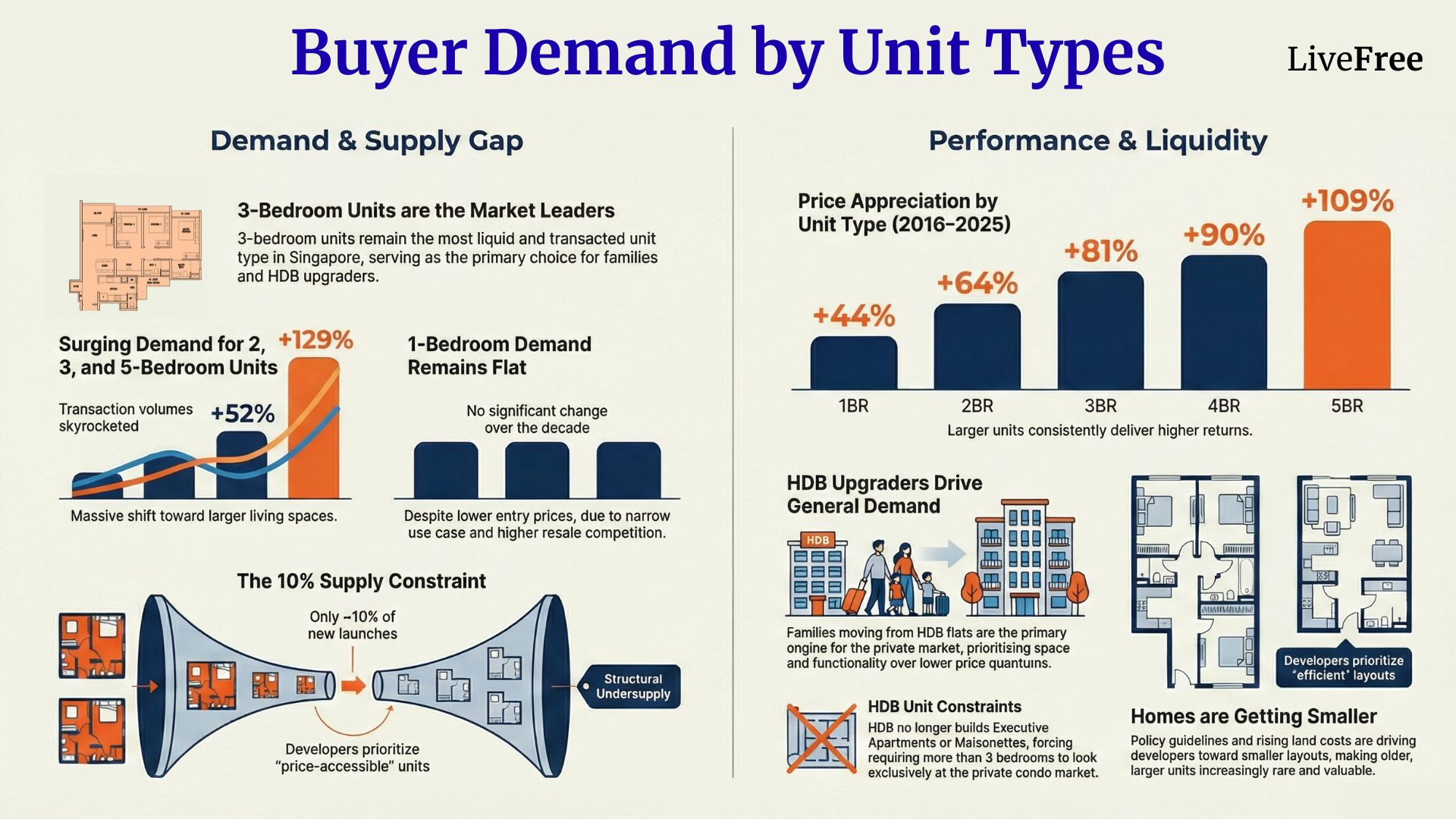

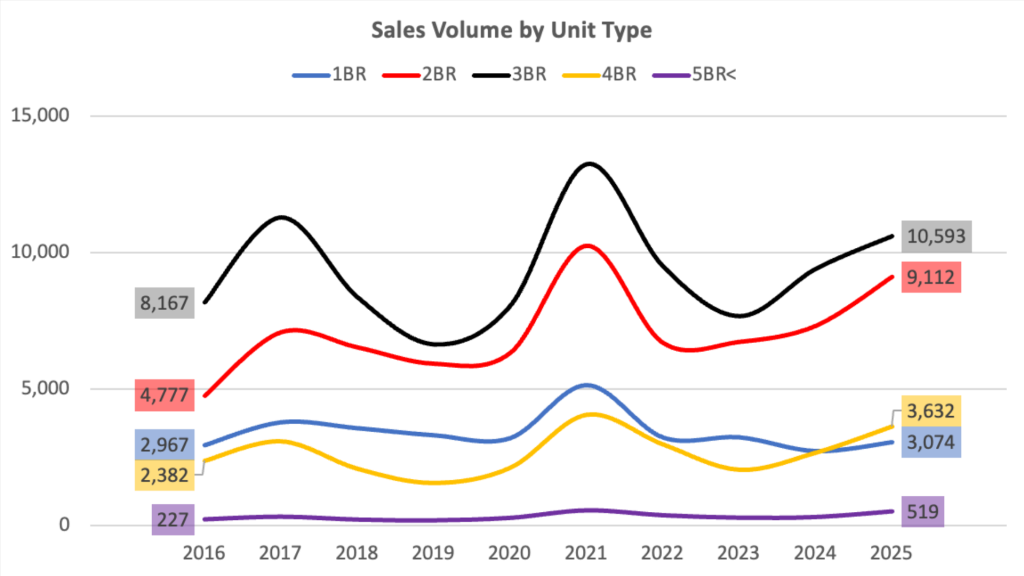

Looking at transaction volumes from 2016 to 2025, buyer demand across condo unit types has not shifted evenly. Different unit sizes have behaved very differently over the past decade.

Over the last 10 years:

Despite shrinking average condo sizes, the data suggests that buyer demand has not shifted away from larger units. Instead, demand for space appears to be constrained by availability rather than lack of interest, especially among owner-occupiers.

While buyer demand for space remains evident, new launch condo supply in Singapore tells a different story.

A typical new launch project today is broadly made up of:

This unit mix helps developers keep entry prices accessible and achieve strong launch-day sales. However, it also results in structural undersupply of larger condo units across the market.

For homebuyers searching for 4 or 5 bedroom condos in Singapore, this means:

For sellers, this often translates into less direct resale competition compared to smaller units.

This mismatch between demand and supply explains why transaction volume alone does not fully reflect true buyer interest in larger homes.

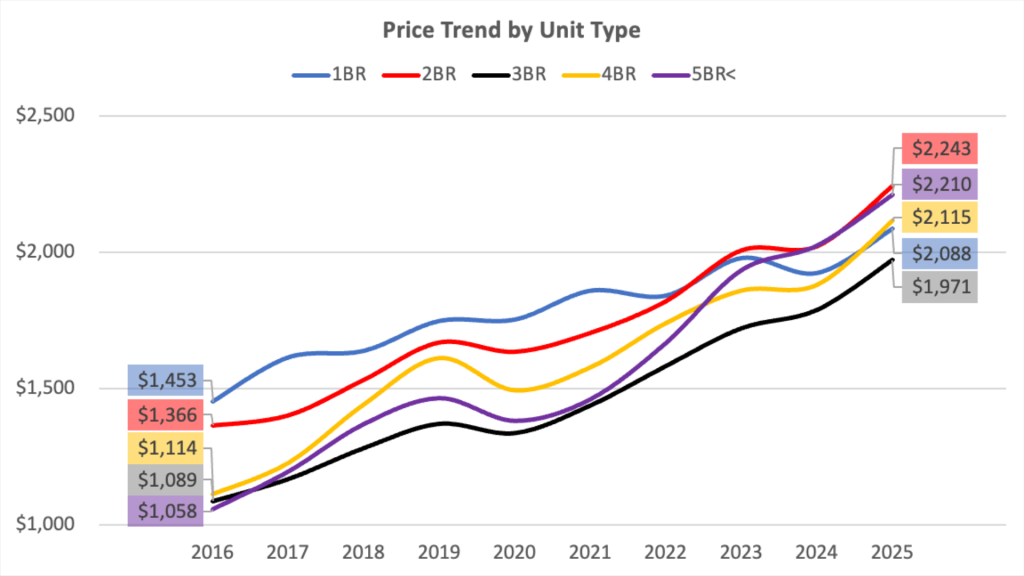

If buyer demand were genuinely shifting away from larger units, this would likely show up in long-term price performance. However, the data points in the opposite direction.

Average Price Appreciation by Unit Type (2016–2025)

Despite lower transaction volumes, larger condo units have delivered stronger long-term price appreciation. This reflects not only buyer demand, but also scarcity and replacement cost pressure.

Owners of larger units tend to hold their homes for longer, and are often older buyers. A replacement purchase typically involves:

As a result, upgrading or replacing a large home often requires a substantial cash commitment, making such moves less attractive unless the buyer has very strong liquidity.

These financial constraints become more pronounced over time, which explains why owners of larger units are less inclined to sell and re-enter the market, reinforcing longer holding periods and limiting resale supply.

Several structural factors help explain why buyer demand has not meaningfully shifted away from larger condo units.

HDB no longer builds Executive Apartments or Executive Maisonettes. Most HDB flats today offer a maximum of three functional bedrooms. The largest HDB format, 3GEN, requires two families to purchase together. As a result, households that need more rooms can only turn to the private market.

Hybrid and remote work arrangements have increased the functional value of additional rooms, even as average household sizes decline.

Overall condo unit sizes in Singapore have been shrinking over time due to planning guidelines, rising construction and land costs, and increasingly “efficient” layouts. This has made larger homes progressively harder to replace.

Larger units transact less frequently, but remain highly sought after due to scarcity.

Singapore’s property market typically experiences gradual price growth rather than sharp crashes. Waiting often results in higher prices or smaller homes, not better entry points.

Due to the 5-year ABSD sell-out timeline, developers are increasingly cautious about building very large units. This structural constraint makes larger homes rarer over time.

Smaller units may transact more frequently, but larger units have historically shown stronger long-term appreciation due to scarcity and holding power.

The broader pattern shows that larger units tend to appreciate better over the long term. However, trying to save up indefinitely for a bigger home is a common mistake.

A 1-bedroom condo today costs as much as a 3-bedroom condo did 10 years ago.

A more sustainable strategy is to enter the market when you are ready, build capital over time, and upgrade when opportunities arise. The risk most buyers underestimate is replacement cost — being forced into a smaller home or a higher price point later.

Staying invested is often better than inaction.

Should you get a Bigger Home or a Better Location? This is one of the dilemmas that homebuyers face today. Speak to us if you want to know more..

LiveFree

Hi

We offer private property consultations for readers. Interested?