Boutique condo projects in Singapore are often marketed as exclusive, private, and premium. With smaller unit counts, distinctive designs, and low-density living, they appeal strongly to buyers seeking something different from mass-market developments.

But beyond aesthetics and branding, how do boutique condominiums actually perform as an asset class?

In this LiveFree Market Insights, we take a data-driven and on-the-ground look at boutique condos in Singapore, examining their liquidity, pricing behaviour, valuation dynamics, and how different stakeholders — developers, bankers, buyers, landlords, and tenants — interact with these projects.

This is not an article to praise or criticise boutique developments. Instead, it is designed to help buyers understand the structural trade-offs behind boutique projects, so decisions are made deliberately — not emotionally.

Key Takeaways: Boutique Condos at a Glance

For the purpose of this article, boutique condominiums are defined as private residential projects with fewer than 200 units.

This threshold is not arbitrary. When analysing transaction data, pricing behaviour, and resale performance, projects below this size consistently exhibit distinct liquidity and valuation patterns compared to larger developments.

How Common Are Boutique Projects?

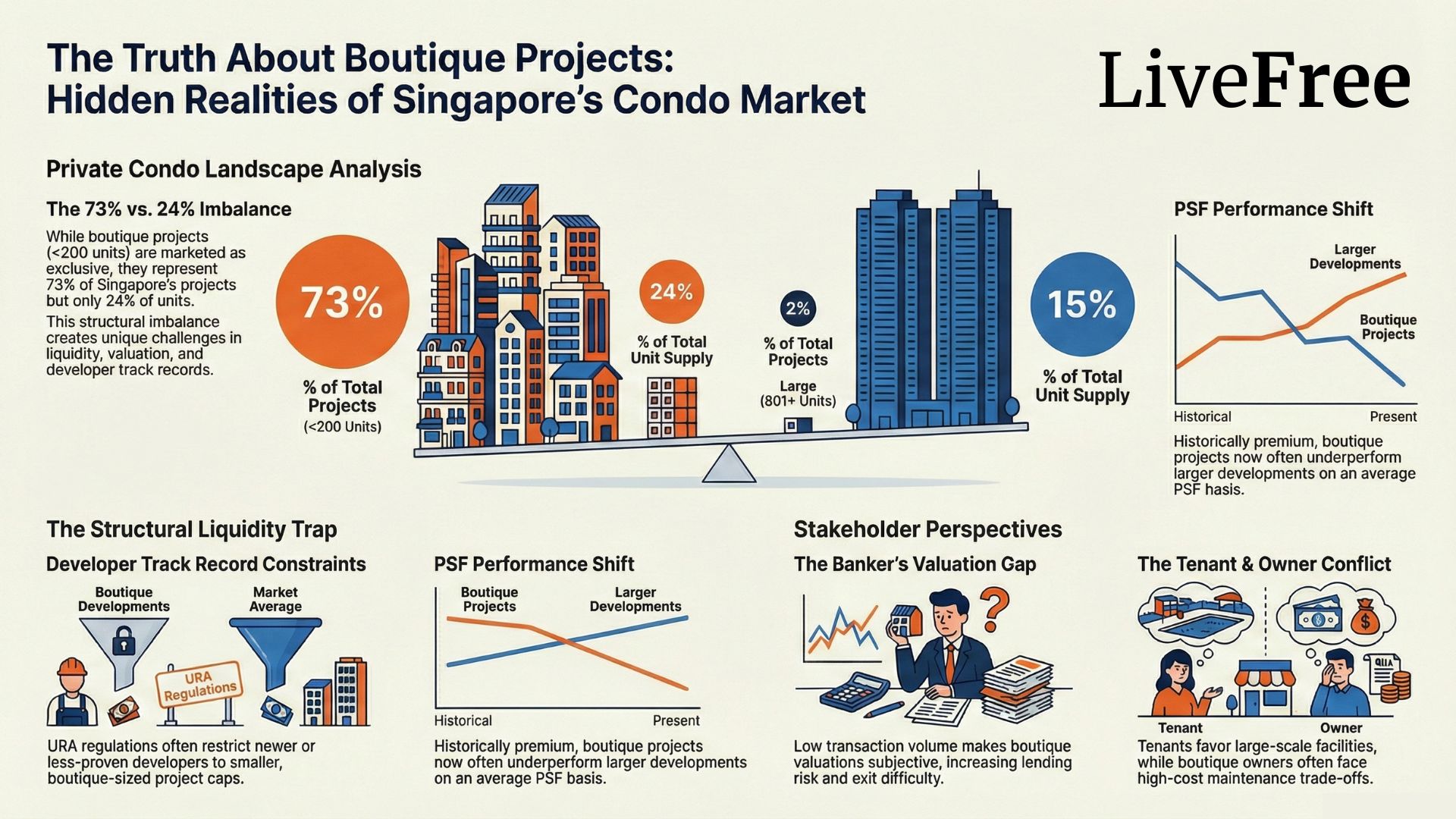

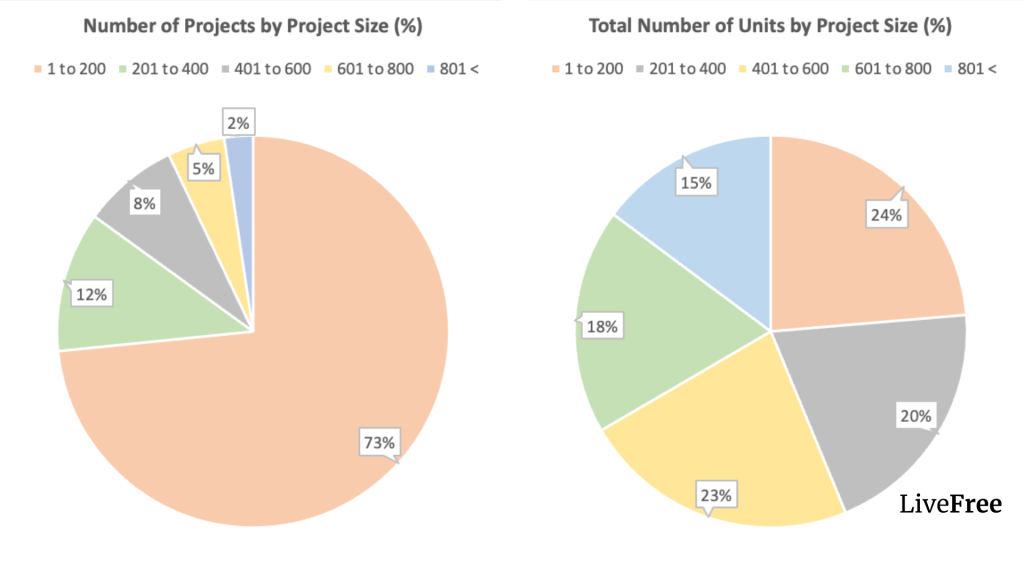

Based on project size distribution, approximately 73% of private non-landed residential projects in Singapore have fewer than 200 units, yet these projects account for only 24% of the total unit supply. Conversely, projects with more than 800 units make up just 2% of developments, but contribute 15% of total supply.

This imbalance leads to a key insight often missed by buyers:

Boutique condos face resale competition not because there are too many units — but because there are too many similar-sized projects, each with unique layouts, designs, and buyer appeal.

Liquidity: The Silent Risk of Boutique Condos

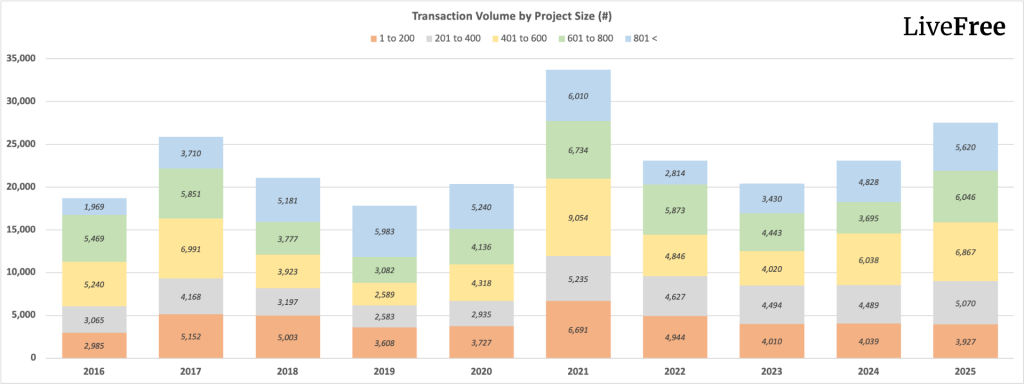

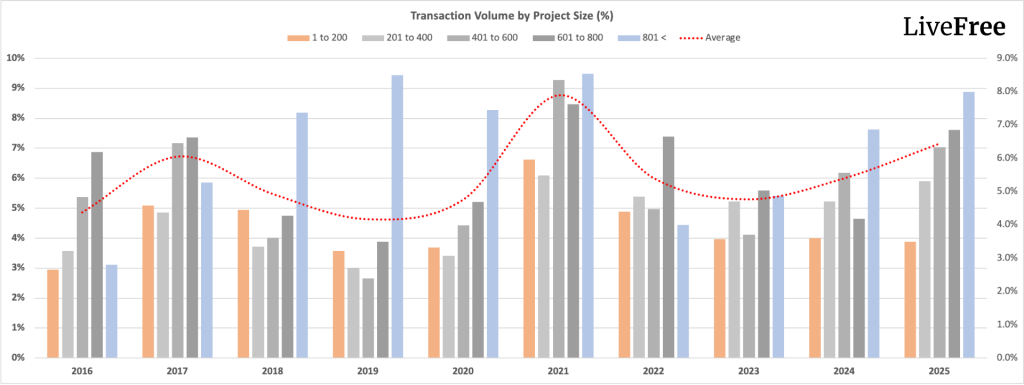

When we examine transaction volumes over the past 10 years, all project sizes appear to move broadly in line with overall market activity.

However, once transaction volume is normalised against total supply, a clear pattern emerges. Boutique Condos consistently record below-market average transaction volumes as a percentage of total units, while larger Condos tend to stay near or above the market average.

This tells us that, as a group, boutique projects are structurally less liquid — regardless of market cycle.

Why Liquidity Matters

Lower liquidity directly impacts:

For buyers treating property as a long-term asset, this difference matters far more than design or branding.

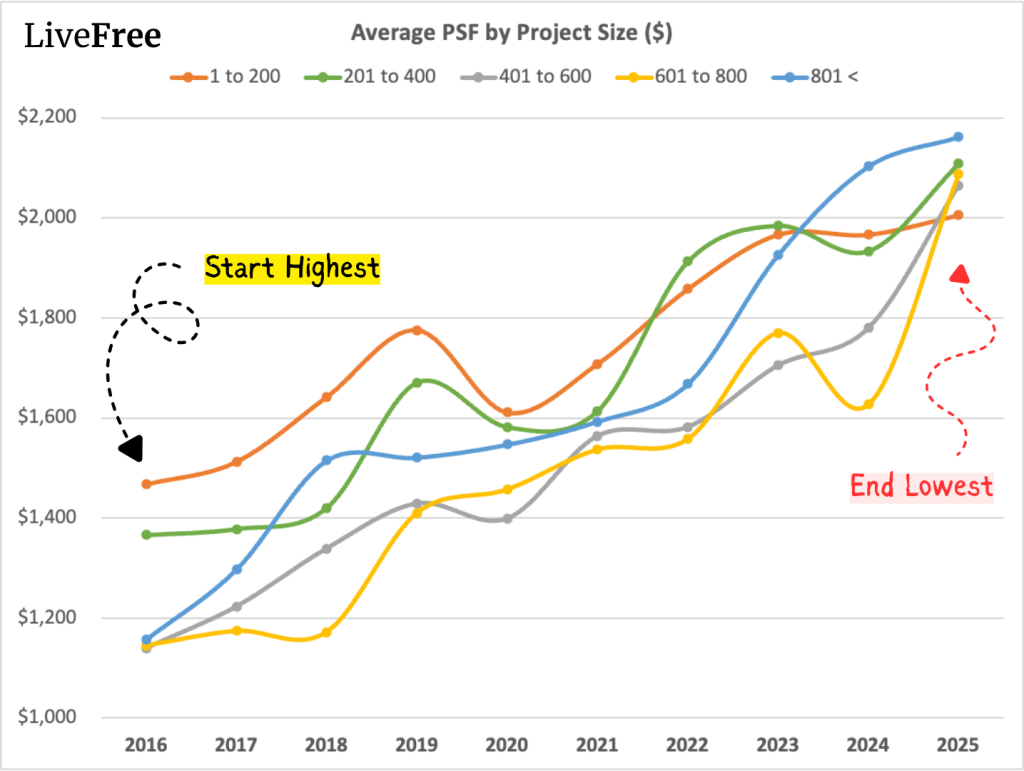

Average PSF Trends: Why Boutique Projects Have Underperformed

Historically, smaller developments once commanded a price premium, often associated with luxury Boutique Condos in prime or central locations.

Over the past decade, however, Boutique Condos in Singapore have underperformed larger developments on an average PSF basis.

This reflects a deeper structural shift:

Boutique Condos, by contrast, often depend on niche demand, which tends to be less stable across different market cycles.

Beyond data, market behaviour is shaped by incentives and constraints across different stakeholders.

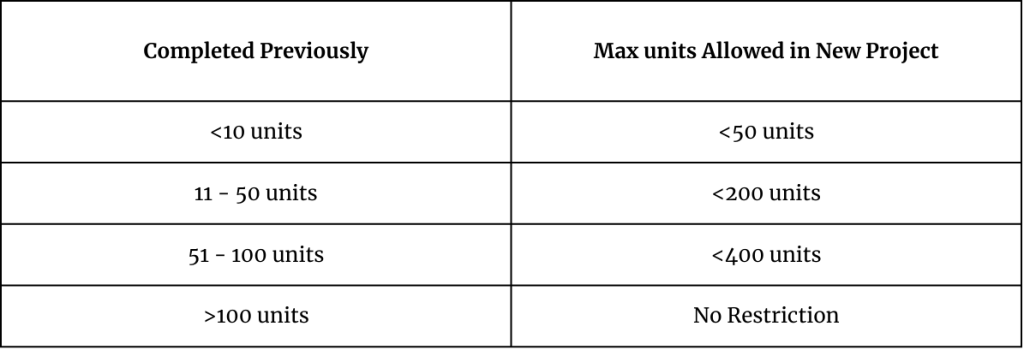

Developers: Track Record Shapes Project Size

URA regulations introduced in 2016 restrict the size of projects developers can build based on their past completion history:

In addition, the BCA CONQUAS framework applies:

As a result:

This is not a criticism — but a structural reality buyers should factor in.

Bankers & Valuations: Risk Over Design

Bankers are not property experts; they are risk managers.

Larger projects offer:

Boutique Condos often feature:

This makes valuation more subjective, widening the gap between seller expectations and bank valuations.

Buyers & Sellers: The Valuation Gap Problem

In boutique developments:

With fewer transactions, negotiations become harder and deals take longer to close — a challenge less common in larger developments with frequent price discovery.

Landlord vs Homeowners: MCST Misalignment

Condominium management decisions depend on voting by share value.

Conflicts arise when:

In developments with a high landlord ratio, upgrades may stall — leading to gradual deterioration in maintenance standards over time.

Tenant’s perspective on Boutique Condos

Tenant demand tends to favour:

Many Boutique Condos are located in low-density private enclaves, which may appeal to homeowners but limit rental demand when pricing converges with larger developments.

Not at all. Some Boutique Condos outperform because they offer:

However, these are exceptions, not the rule — and identifying them requires deeper filters than size or branding alone.

Boutique Condos may suit buyers who:

Boutique Condos are generally less suitable for:

The Key Question is not: “Is this a Boutique Project?”

The Right Question is: “Does this project have enough liquidity, valuation support, and buyer demand beyond me?”

Boutique Projects can work. But only when buyers understand the trade-offs clearly and deliberately.

Live Freely, Find the Right Home with us today..

LiveFree

Hi

We offer private property consultations for readers. Interested?